Wise

Wise, formerly known as TransferWise, represents a paradigm shift in international banking and money transfers, catering to a global audience across 160 countries and 40 currencies. Its main allure lies in its cost-effective, transparent approach to international transactions. By minimizing fees for money transfers and currency conversions, Wise has become a go-to for those seeking an economical alternative to traditional banking fees, especially for frequent international transactions.

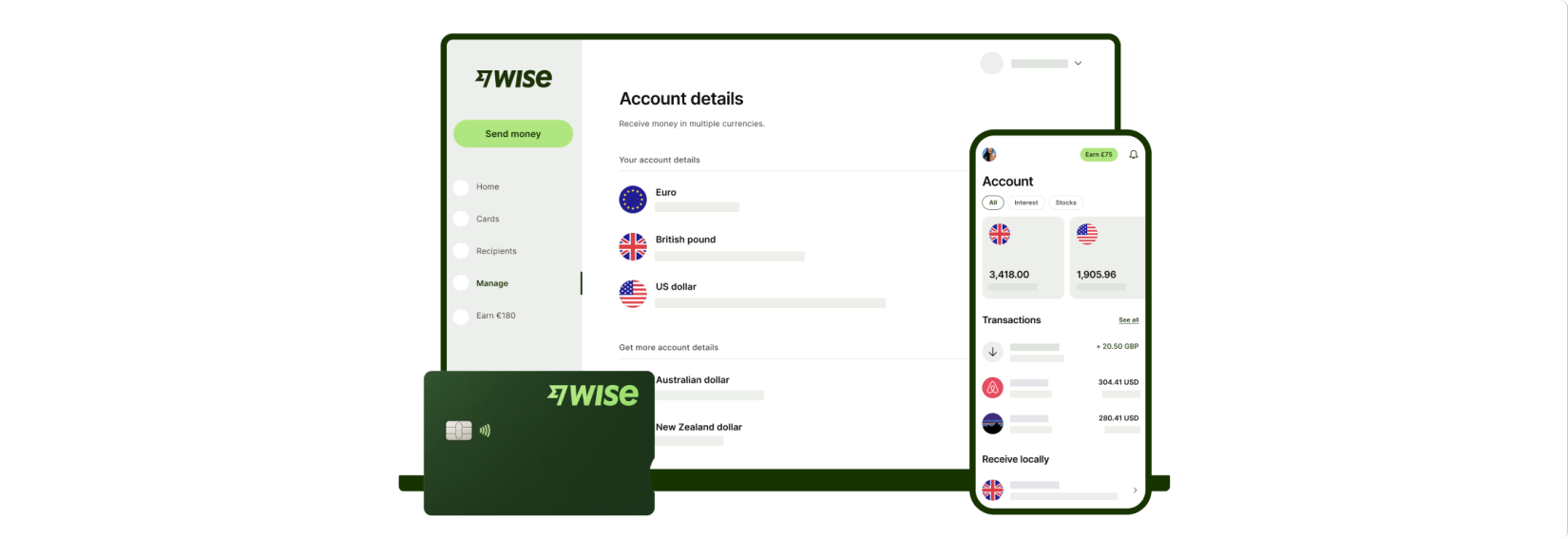

The Wise debit card simplifies currency management, offering live rate conversions across over 40 currencies. This feature is particularly beneficial for travelers and international businesspeople, who can now avoid the hefty fees usually associated with currency exchanges.

Interest rates on USD balances are another standout feature, with Wise offering a competitive 4.33% APY. This, combined with the instant access to funds, positions Wise as an attractive option compared to conventional savings accounts.

Security is a top priority for Wise, as evidenced by their handling of approximately £10 billion of customer money each month. This demonstrates the trust customers place in Wise and the company's commitment to safeguarding these funds.

Wise's transparent pricing model is particularly noteworthy. There are no hidden fees or subscription costs, and users only pay for the services they use. While some services, like money transfers and currency conversions, incur fees starting from 0.43%, these are generally lower compared to traditional banking services.

Summary

In summary, Wise offers a versatile, cost-effective, and secure solution for international banking and money transfers, with transparent pricing and a range of financial services. Its focus on low fees, real exchange rates, and user-friendly features makes it an appealing choice for those engaging in international transactions, travel, or requiring a multi-currency account.

Global Reach

Competitive Money Transfer Fees

Attractive Interest Rates

Pros and Cons

-

Fast onboarding process

-

Low fees

-

Multiple local payment solutions

-

Multi-currency support

-

Accounts can be blocked easily

-

Complex compliance with no clear timeline

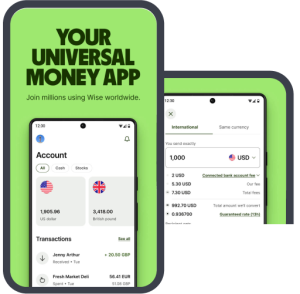

Product Video

Ideal For

-

Frequent International Travelers and Expats - Able to handle multiple currencies and offer real-time currency conversions

-

Individuals & Businesses into International Transactions - Offers low-cost, efficient cross-border money transfers and currency management

-

International Freelancers - Reduced conversion fees by means of multi-currency account and debit card simplify transactions in various currencies

What's On Offer?

-

Multi-Currency Transactions

-

Competitive Money Transfer Fees

-

Real-Time Currency Conversion

-

Attractive Interest Rates

-

Transparent Pricing Model

Help & Support

Wise is known for its robust customer support, designed to cater to the diverse needs of its global customer base. They provide comprehensive assistance through various channels, ensuring that users can access support in a way that suits them best. Wise maintains an extensive online help center that covers a wide range of topics. This resource is particularly useful for self-service information, offering guidance on everything from setting up accounts to managing transactions.

Account Protection and Security Measures

Wise offers robust protection and security measures as a form of ‘warranty’ to its users, ensuring the safety and security of their funds and transactions. Prioritizing the trust of its global customer base, Wise handles billions in customer funds each month, reflecting the high level of security and reliability inherent in their services. This includes employing advanced encryption and fraud prevention techniques to safeguard accounts and transactions.

Wise

Bottom line

Wise's strengths lie in its global reach, low fees for currency conversion and transfers, competitive interest rates, and a transparent pricing model. These features make it particularly beneficial for frequent travelers, online shoppers, freelancers working with international clients, and anyone involved in global transactions. While the lack of physical branches and variable fees for some services might be drawbacks for certain users, the overall value proposition of Wise is compelling.