We got used to in-store payment, but nowadays, we have a trend about online paying that is becoming more popular and efficient. Every online transaction implies four participants:

- Cardholder (credit car owner)

- Merchant (business owner)

- Acquirer (bank from a merchant side)

- Issuing bank (bank from a consumer side).

In 1871 Western Union presented the first electronic fund transfer. Since then, until the 1960s, this process was slowly improving. The Federal Reserve of America in the 1910s started to use a telegraph to transfer money. A new chapter in online payments’ development rockets with an internet era. Today, it’s the well-adjusted sphere. Online payment processing is required for businesses that utilize or intend to use online payments. The in-store method of going business also depends on the online payments system.

Let’s see the best Credit Card Processors today’s list

Recent occasions with a pandemic sharply increased demand for payments processors not to spread the disease through fiat money. And this technique recommends itself so well that it’s obvious now of its efficiency and prospects. Now nearly 20% of total retail purchase was made digitally, and ten years ago, this index was almost 7%. According to Digital Commerce 360 analysis of U.S. Department of Commerce data, $598.02 billion was spent online in 2019, and in 2020 it was $791.70 billion.

Managing Online Payments with Online Processing Providers

Online and cashless payments are so widespread that businesses need to engage payment processing providers for their development and efficient work. This term is pertinent for online as well as in-store payments because both are cashless in general.

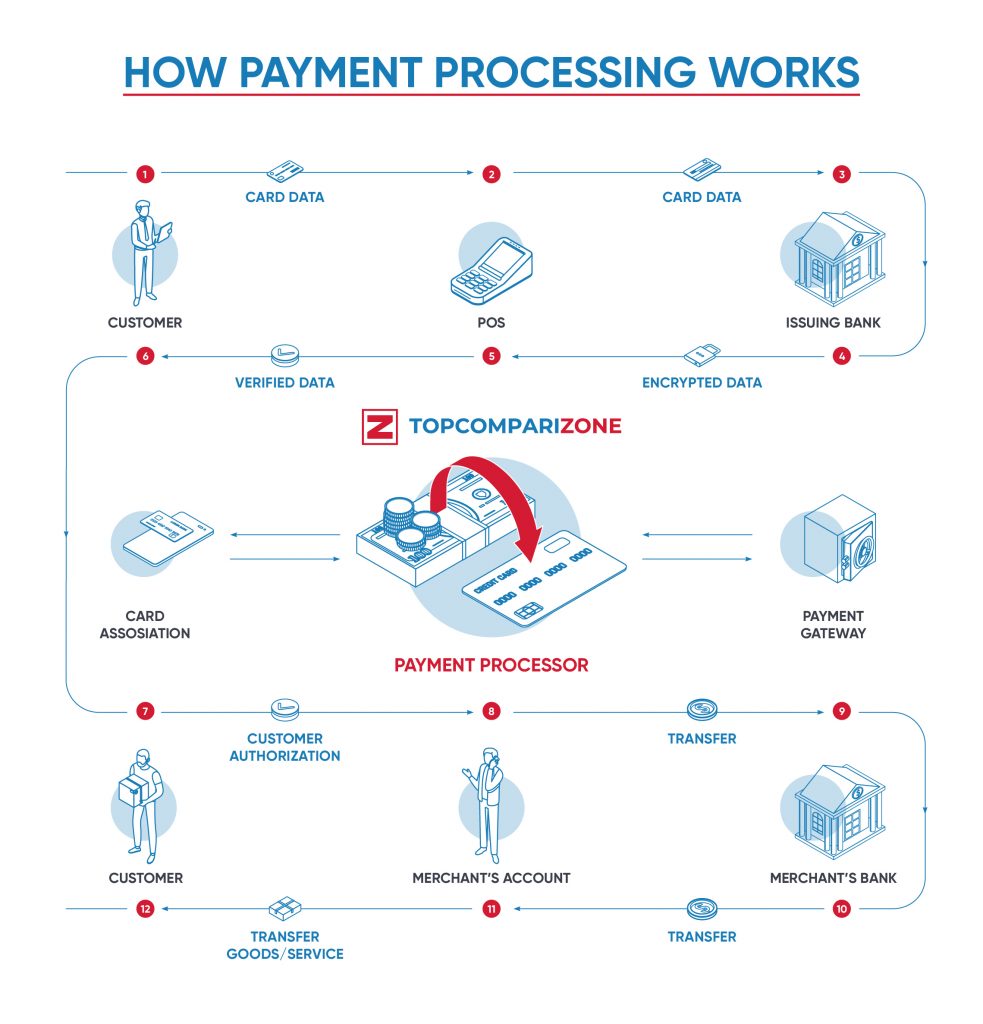

While making purchases, a lot of digital operations execute in the background. A customer, a merchant, payment gateway, issuing bank, a payment processor, and merchant bank are participants of payment processing.  Here is an infographic about nuances of payment processing

Here is an infographic about nuances of payment processing

Maybe it seems easy, but indeed, payment processing is a sophisticated operation, and it has a lot of stages:

- The customer pays by card

- The shop sends data to the provider of card reader

- The provider of a card reader sends a request to the card issuer

- The card issuer sends an authorization request to the person’s bank

- The person’s bank authorizes the transaction

- The card issuer sends the authorization to the shop

- The shop receives authorization

- The card reader provider sends a list of transactions to the card issuer

- The card issuer and banks settle net transactions

- The person’s bank statement shows the money has gone out.

A consumer does not see the whole process — he’s waiting for a few seconds to receive a confirmation that his money is written off. There’re a variety of payment instruments: POS terminals, website payment forms, QR-codes, etc. The market is filled with a significant number of processing providers. Indeed, it takes lots of time to find reliable companies among them, suitable to in-store or online methods, that already have facilitated many businesses to grow with their support. American Express Digital Payments survey shows that 71% of merchants confirm that their mobile and online sales are increasing every year. Consumers spend 12-18% more with credit cards than with cash, reports Dun and Bradstreet. There is an extensive variety of businesses differentiated by categories and types. Online and in-store options are relevant for a considerable quantity. Payment processors’ market can give the best decision according to the niche and type (in-store/online) of business. Processors that don’t match your needs won’t have a positive effect. It’s necessary to combine it rightly because in-store and online types have different shapes, and the payment processing approaches must be appropriate. Generally, payment processing is similar for any business, but there are some key differences regarding the particular type. The in-store business type has to use physical terminals, online stores must give their consumers a convenient payment form via the internet, significant manufacturing already has an entire payment system. And depending on all these details, the consumer chooses an individual provider. Payment processing saves your time, and it’s mainly the primary advantage. Also, it allows your customers to pay in any convenient way they want. Providers don’t offer you template conditions, and they’re synchronizing with a business and growing with them. Involving payment processors have exceptional importance for any business in-store or online.

Conclusion

Time is changing — for the last decade, online payment has become often used and was tremendously developed. Business owners realized the potential and all the advantages of payment processors. Furthermore, those who combine online and in-store methods win twice as much.

Compare payment processors by yourself

Payment processing gives only advantages to any business because its possibilities are adapted to any conditions. It remains only to choose a provider according to you. The benefits of conducting business with processors are apparent. No demand to make a financial routine on your own, this huge piece of time can be spent in the way of developing and improving. Regardless of what type and kind of business are yours, this innovative technology will boost scalability in any way.