Payment Depot

Payment Depot is a payment processing company that provides businesses with a range of payment processing solutions. The company offers services such as credit card processing, ACH processing, and electronic check processing, and provides its clients with secure and reliable payment processing solutions that are designed to meet their unique needs.

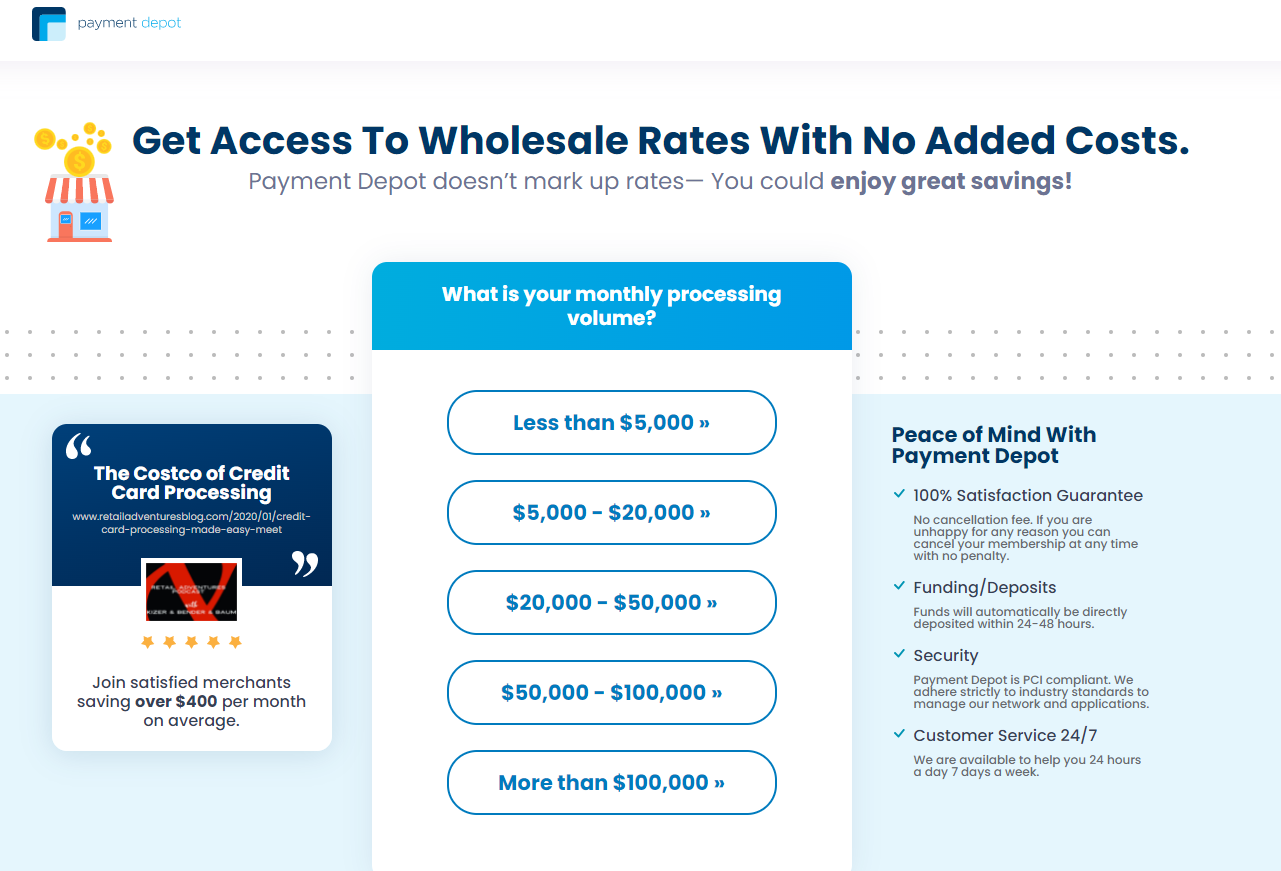

Payment Depot allows businesses to access wholesale financial interchange charges at preset fees to help lower overall expenses. This differs from traditional payment processors, which add markup associated with interchange charges and benefit from business sales. Instead of processing payments as a fee-based solution, Payment Depot works on a subscription fee.

Payment Depot provides businesses with access to wholesale payment rates, so they can save on costs. Unlike traditional payment processors, Payment Depot doesn't markup interchange rates or profit from business sales. Instead, businesses pay a small subscription fee for payment processing.

Payment Depot uses the latest technology to ensure that all transactions are processed quickly and efficiently, while also maintaining the highest levels of security. The company provides its clients with real-time reporting and analysis tools that help them better understand their payment processing activities and make informed decisions about their business.

Summary

Founded in 2013 Payment Depot is based in Orange CA is a division of Wells Fargo Bank. Payment Depot has a subscription-based system where you pay a one-time monthly fee based on the number of sales you make. This makes it easy to calculate your total cost.

There are three monthly tiers for sales up to $500,000 a year, ranging from $59 to $99 a month. If you have a larger sales volume than $500,000, you can call them for a custom quote.

Payment Depot has been a member of the Better Business Bureau since 2015 and has an A+ rating.

In addition to its core payment processing services, Payment Depot also offers value-added services such as customer service, technical support, and training. The company has a dedicated team of customer support specialists who are available to assist clients 24/7 and works closely with its clients to understand their specific needs and to provide customized solutions that meet those needs.

24 Hours Account Approval

24/7 Customer Service

Free EMV Terminal

Pros and Cons

-

90-day risk-free trial

-

No Cancellation fees

-

High level of customer satisfaction

-

Electronic signature

-

High-risk businesses excluded

-

Requires a Payment Depot terminal

Product Video

Ideal For

-

Service companies

-

Retail and restaurants

-

Healthcare

What’s On Offer?

-

Reprogramming of your existing hardware

-

Monthly subscriptions

-

Free equipment

-

Live chat

-

Low Transaction Fees

Plan Pricing

Interchange + 0.5% + $0.15

$49+

Interchange + 0.5% + $0.15

None

None

$19.99

$49

$79

$99

$199

None

Help & Support

Payment Depot has dedicated itself to providing SMBs with credit card processing that is clear, simple, and fair. Part of that commitment is providing great customer support. You can send them a message via online form, Facebook, Twitter, and LinkedIn or give them a call for one-to-one support.

Both sales and support have their own phone number, and you can get in touch with them via their online form. They don’t have an email address or a FAQ page.

Payment Depot

Bottom line

Payment Depot (by Stax) has great reviews on Trustpilot and they answer every review, which shows they care about your customer journey.

There is a great rate calculator on their pricing page so you know what you will pay before you set up your account.

With one fee charged each month you eliminate other hidden fees charged by other credit card processors and save up to $40% compared to a traditional credit card processing company